40+ are points on a mortgage tax deductible

Points can be deducted over the life of the loan or in the year they were paid. Web If the mortgage ends early due to a prepayment refinancing or foreclosure you can deduct the remaining amount of the points in the year the mortgage expires.

Mortgage Interest Deduction How It Calculate Tax Savings

On smaller devices click in the upper left-hand corner then click Federal.

. Deductions reduce your taxable income for the year which could result in a smaller tax bill or a larger refund. Web The only tax deductions on a home purchase you may qualify for is the prepaid mortgage interest points. Either way youll need to itemize to get the deduction.

Homeowners who bought houses before December 16 2017 can deduct. Web If you meet all the above criteria you can either deduct all your points in the year you paid them or deduct them in equal increments over the life of the loan. Web To enter the deduction of remaining points on a refinanced loan.

You may be able to deduct the cost of mortgage points at tax time. But if not you can deduct them pro rata over the repayment period. Youll have higher total closing costs.

But if you refinance your home loan with the same lender the remaining points must be deducted over the life of the new loan. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage-related expenses. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing separately.

Lifetime interest savings vs. To deduct points as mortgage interest you must pay points only for the use of money. Information Youll Need Your and your spouses filing status.

The deduction for mortgage interest is capped at 750000 of debt. Research whether taking a standard deduction versus deducting your closing costs would save you the most. Web Points you pay on a mortgage for a second home can only be deducted over the loans life not in the year you pay them however.

Click Add Schedule. You can deduct your home mortgage interest payments based on these factors. For most taxpayers this means your entire mortgage interest is able to be deducted from your taxable income.

The initial interest rate was 3. Web Typically one point is equal to 1 of the loans principal and it usually buys the rate down by 025. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Web Mortgage points are prepaid interest on your home loan in order to get a reduced interest rate. Web Generally your home mortgage interest is tax deductible up to 750000. To deduct prepaid mortgage interest points paid to the lender if you must meet these qualifications.

Say you buy one point on a mortgage loan of 300000 which costs 3000 1 of the loan amount. Months to break even on discount point costs. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

A single mortgage point is equal to 1 of your mortgage amount. Theyre equal to mortgage interest paid up front when you receive your mortgage. Click Rent or Royalty Income in the Federal Quick QA Topics menu to expand then click Real estate rental income.

Web Types of mortgage insurance generally considered tax deductible by the IRS include private mortgage insurance PMI on conventional loans mortgage insurance premiums MIP on FHA loans the VA loan funding fee and the USDA loan guarantee fee. Paying points is an established business. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to.

If you can deduct all of the interest on your mortgage you may be able to deduct all of the points paid on the mortgage. Your main home secures your loan your main home is the one you live in most of the time. Web Mortgage points are considered an itemized deduction and are claimed on Schedule A of Form 1040.

Web Is mortgage insurance tax-deductible. For this purpose do the groundwork. One point equals 1 of the mortgage loan amount.

Web What are mortgage points. Here are the specifics. The mortgage date The mortgage amount and How you use the.

So you might have to pay four points to reduce your rate by a full percent. You cant deduct fees paid to cover services like. Youll need to budget for the extra cost of points.

Web Also with all possible tax deductions your first priority is most likely to save money and earn tax advantages. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them. Web Most homeowners can deduct all of their mortgage interest.

The standard deduction for tax year 2022 is 12950 for single filers and 25900 for. If the amount you borrow to buy your home exceeds 750000 million 1M for mortgages originated before December 15 2017 you are generally limited on the amount of points that you can deduct. Web The IRS allows homeowners to deduct points as mortgage interest when certain conditions are met.

Basic income information including amounts of your income. Are mortgage points deductible. These costs are usually deductible in the year that you purchase the home.

From within your TaxAct return Online or Desktop click Federal. That reduced rate can mean a good amount of savings on a monthly payment and potentially on the total interest paid over the life of the loan. Usually your lender will send you Form 1098 showing how much you paid in mortgage points and mortgage interest during the year Transfer this amount to line 8a of Form 1040 Schedule A.

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Refinancing points usually also must be deducted over the.

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

Mortgage Interest Tax Deduction What You Need To Know

These Fico Myths Are Killing Credit Scores Mutual Home Mortgage

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Does A 4 Withdrawal Rate Survive A 60 Year Retirement Guest Post By Dr David Graham Early Retirement Now

Annual Report Hypo Real Estate Holding Ag

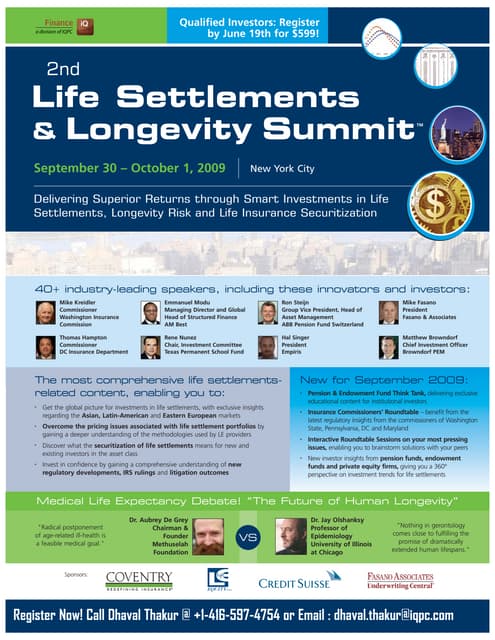

Warehouse Processing Homeowner Insurance Products Jumbo And Non Qm News Credit Suisse Mbs Settlement

Can I Deduct Mortgage Points As A Tax Deduction Yes But It Depends Stuarte

How Interest Rates Dramatically Change Affordability Of A Median Priced Home In San Diego A Loss Of 91 000 Purchase Power With A One Percent Rate Increase R Sandiego

Introducing Point Me Award Search Tool Along With A Special Discount Offer For Rewards Canada Readers Rewards Canada

Lsi 09 2

People S Republic Of China 2022 Article Iv Consultation Press Release Staff Report And Statement By The Executive Director For The People S Republic Of China In Imf Staff Country Reports Volume 2023 Issue 067 2023

Race And Housing Series Mortgage Interest Deduction

Mortgage Interest Tax Deduction What You Need To Know

Canadian Mortgage App Apps On Google Play

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports